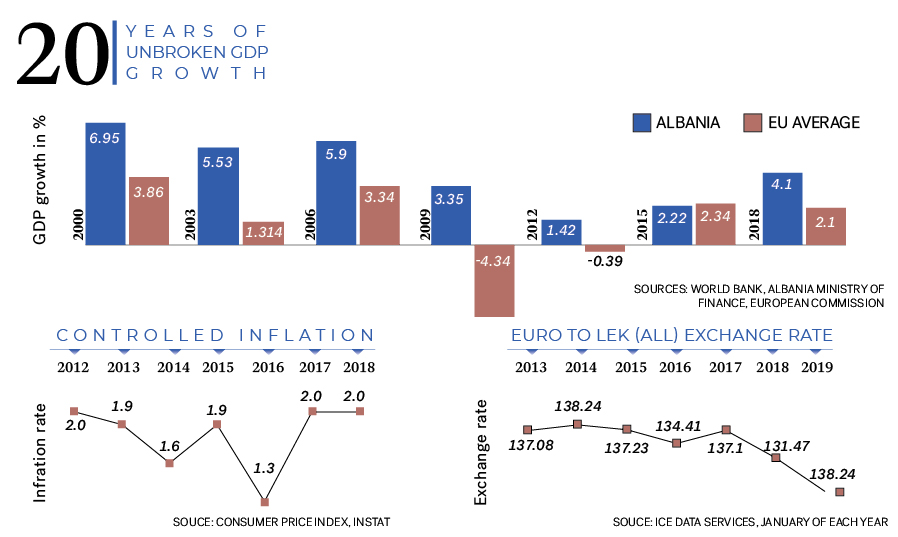

Albania’s financial sector has provided the framework to support a GDP growth streak of 20 years and counting

“Albania’s economic growth didn’t come out of nowhere,” said Gent Sejko, governor of Albania’s central bank, explaining that it was achieved on the back of the reforms carried out by policymakers and the central bank, which has maintained financial stability and economic growth since 1997.

Today, Albania’s banking system can be characterized by two key factors, according to Andi Ballta, CEO of American Bank of Investments (ABI) – high liquidity and ongoing consolidation.

“As a business owner in Albania, you have full access to banking, and the banks are very competitive – in fact, as competitive as I’ve seen,” said the head of ABI, which has purchased the subsidiaries of two international banks operating in Albania since 2015.

“The banking system has been closely monitored and regulated, and this has given a lot of confidence to us as a foreign investor,” he added.

Along with consolidation – the number of banks will fall from 16 in 2018 to 12 by the end of this year – Albania’s banking sector has also seen the rate of non-performing loans drop from 25 percent in 2015 to 11 percent in 2019.

Though lending has been growing at a rate of five percent year-on-year, Albania’s central bank has held the benchmark interest rate at a historically low one percent since 2018.

The country’s currency, the Albanian lek, has also been stable yet steadily appreciating since 2015.

Standard & Poor’s credit rating agency is optimistic that Albania’s financial system will hold steady in years to come as well, predicting an average of four percent GDP growth for Albania through 2022.